Why Invest with Woodside?

A company committed to optimising shareholder value and returns.

Creating shareholder value through scale, diversity, and resilience

When you invest with Woodside, you’re investing in a global energy company with a diversified portfolio in advantaged locations and markets.

Woodside’s business model seeks to optimise returns across the value chain by prioritising competitive growth opportunities, utilising our operational, development and technological capabilities, and deepening relationships in energy markets with strong demand growth.

Woodside recorded a half-year net profit after tax (NPAT) of US$1.74 billion

Underlying NPAT was US$1.896 billion, up 4% on the corresponding period in 2022, reflecting a full period of results with Woodside’s expanded operations portfolio. Operating revenue rose 27% period-on-period to US$7.4 billion.

-

US$1.7 BILLION

net profit after tax

-

US$7.4 BILLION

operating revenue

-

US$1.9 BILLION

underlying net profit after tax

-

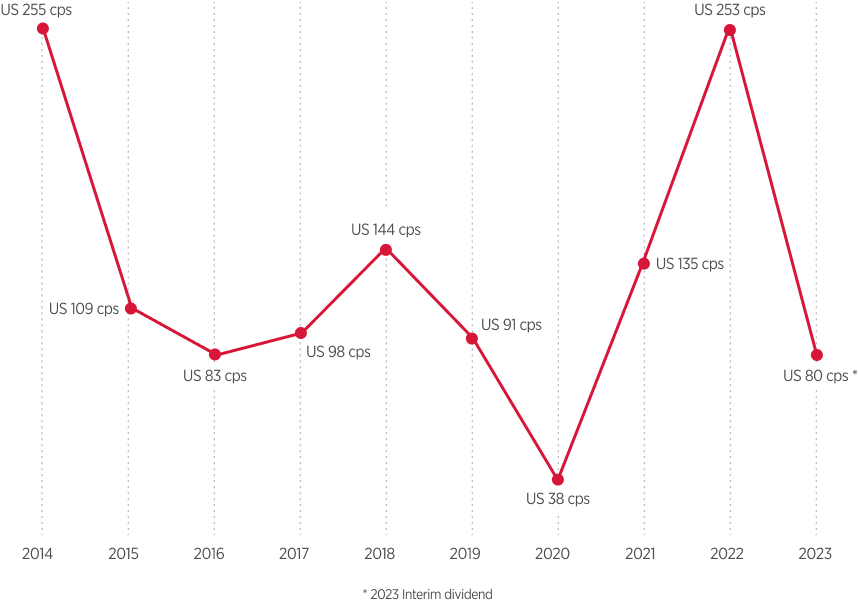

80 US CPS

interim dividend

Optimised value and shareholder returns

In 2022, the merged company delivered record profit driven by our larger, geographically diversified portfolio, and made significant progress on our growth projects.

-

$6.5 BILLION

net profit after tax for 2022

-

$16.8 BILLION

operating revenue for 2022

-

$6.5 BILLION

free cash flow for 2022

-

253 US CENTS

per share full-year dividend for 2022

A history of strong dividends

With a history of delivering strong returns to shareholders, we have built a track record of success.

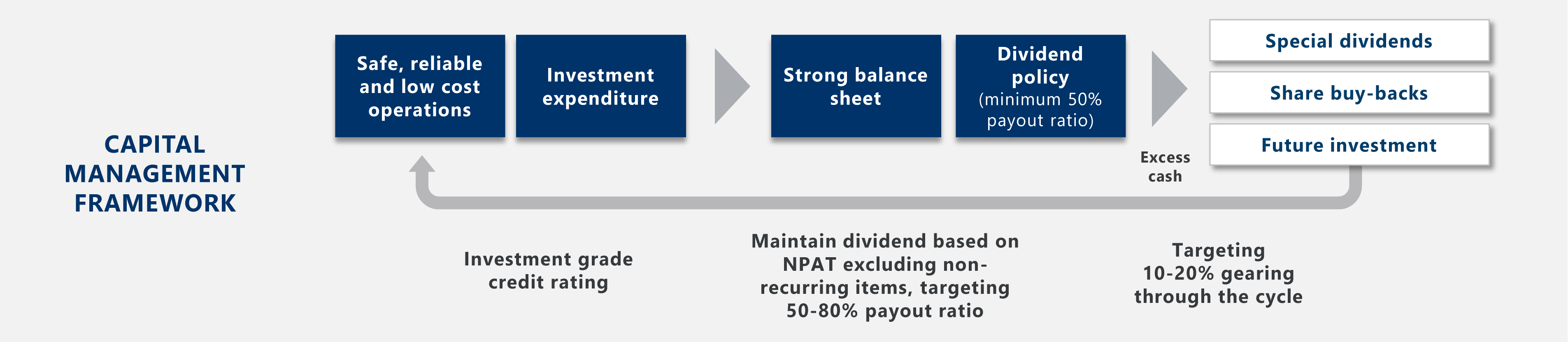

Providing long-term stability and value to our shareholders

At Woodside, our capital management framework provides us with the flexibility to optimise value and shareholder returns delivered from our portfolio of opportunities. Our disciplined and responsible approach to investment ensures we manage financial risks and maintain a strong financial position. By doing so, we are able to maximise the value we deliver to our shareholders.

With a robust capital management framework in place, we're striving to ensure that Woodside remains a resilient and diversified company in the future

We have growth opportunities across our three pillars of oil, gas and new energy

The Scarborough and Pluto Train 2 projects in Australia were approved in November 2021, with first LNG cargo expected in 2026. Work on the Sangomar Field Development commenced in early 2020 and first oil is targeted for mid-2024.

Our new energy opportunities include the proposed hydrogen and ammonia projects H2Perth and H2TAS in Australia and the proposed hydrogen project H2OK in North America.

And our resilient and diversified portfolio will help us thrive through the global energy transition.

Investor enquiries

Email:

Mailing Address:

Investor Relations

GPO Box D188

Perth

WA

6000

Australia

Computershare Investor Services Pty Limited

Phone:

1300 558 507

Email:

Mailing Address:

GPO Box 2975

Melbourne

Victoria

3001

Australia

Street Address:

Level 17, 221 St Georges Terrace

Perth

Australia